The Chipotle Ultimatum: A Tough Pill to Swallow

Demand News • June 2, 2016

I love burritos.

More specifically, I love burritos from Chipotle. Brown rice, steak, hot salsa, extra mild salsa – don’t leave until you are swimming in pico de gallo – lettuce and, of course, guacamole. Once upon a time, three or four trips through the Chipotle queue were not out of the question for a five day work week. What can I say, I appreciate the finer things in life. And there’s nothing finer than a well-constructed Chipotle burrito.

So you can imagine my devastation during the recent string of bad news coming from the Chipotle camp. One after another, restaurants were shutting down with reports of norovirus, E.Coli, and other appetizing gastrointestinal disruptors. Stock prices dissolved quicker than Pablo Sandoval’s belt, and the once serpentine lines that formed every day at lunch and dinner disappeared. For a restaurant chain, it is a nightmare scenario.

Until, of course, you hear about their most recent plans to deviate from their core business. “Beleaguered burrito company Chipotle Mexican Grill,” one financial site reports, “applied for a patent with the U.S. Patent and Trademark Office on March 11 in an effort to launch a new chain of hamburger restaurants.”

This venture would essentially act as competition for Shake Shack and Five Guys. A spokesman for Chipotle told Bloomberg, “We have two non-Chipotle growth seeds open now ― ShopHouse and Pizzeria Locale ― and have noted before that the Chipotle model could be applied to a wide variety of foods.”

Under normal circumstances, this would be a great move. The fast-casual style of dining has proven effective and profitable. If the operational methodology is functioning, the type of food is secondary. It could be applicable to just about anything. But as the mothership is crashing down to earth, the decision to focus on innovation and diversification seems puzzling. And when your company struggles with E.Coli outbreaks, it may not be the best decision to roll out a new red meat item.

Chipotle would be wise to recall the powerful Tylenol lesson from 1982. It’s difficult to imagine a time when the now-ubiquitous pill would have an issue with public trust. But food poisoning pales in comparison to what Johnson & Johnson faced.

“It was at this point, early October of 1982, that investigators made the connection between the poisoning deaths and Tylenol, the best-selling, non-prescription pain reliever sold in the United States at that time,” a PBS report explains. “The gelatin-based capsules were especially popular because they were slick and easy to swallow. Unfortunately, each victim swallowed a Tylenol capsule laced with a lethal dose of cyanide.”

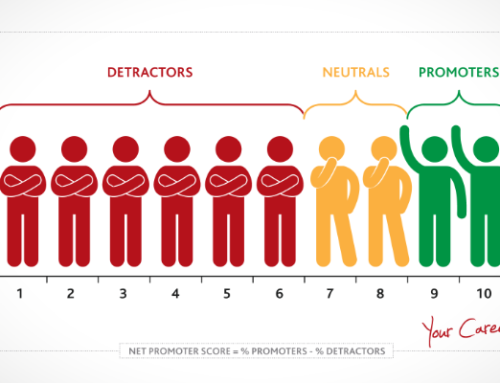

The corporate response has become a model case study for business students everywhere. Before the tragedy, J&J held over 35% of the over-the-counter market. After the events, it went into freefall, and held less than 8%. Incredibly, after a massive investment in manufacturing regulation, criminal investigations, media communication and wholesale corporate transparency, sales rebounded to their previous levels in a year’s time.

Chipotle stock may take more than a year to rebound. They may not rebound at all. But they are one of the lucky few companies that has built up significant brand equity that may buy them enough time to rectify their mistakes. But to do that, they need to focus the whole of their energy on Chipotle itself, like Tylenol did before them.

Take it from me. I’m willing and eager to have burritos become the controlling stake in my diet once again. The audience is there, Chipotle. But don’t distract yourself with burgers. A consistent product with the promise of value and cleanliness brought me into your store years ago. All I ask is that you renew that contract.

Sell me a burrito.